Data collection, insights, reporting and actions for ESG

Problem Addressed

With the built environment responsible for 25% of the UK’s carbon emissions, the real estate industry plays an important role in decarbonising the built environment. When developing ESG strategies across large portfolios, organisations require a clear understanding of the performance of their current assets. These strategies can be even more difficult to create without a robust way to collect and analyse a variety of data sources from differing suppliers, many of which use different standards. It can also be challenging for organisations to effectively understand their current ESG performance and compare this to their ESG goals and commitments. This is particularly problematic, as the lack of a robust ESG strategy and net zero pathway impacts assets in terms of regulatory compliance, attractiveness, and value, and can act as a significant barrier to accessing capital, with lenders increasingly taking ESG criteria into account.

Case Study

Deepki partners with Primonial REIM to help them develop a comprehensive ESG strategy. Primonial REIM has over 1,000 assets throughout Europe and have faced difficulties accessing data from a variety of suppliers and sources, each with different standards. With Deepki, they were able to create a global ESG strategy which they can implement across their international portfolio.

Facts and Figures

This page presents data, evidence, and solutions that are provided by our partners and members and should therefore not be attributed to UKGBC. While we showcase these solutions for inspiration, to build consensus, and create momentum for climate action, UKGBC does not offer commercial endorsement of individual solutions. If you would like to quote something from this page, or more information, please contact our Communications team at media@ukgbc.org.

Related members

Related

Structured data on building performance

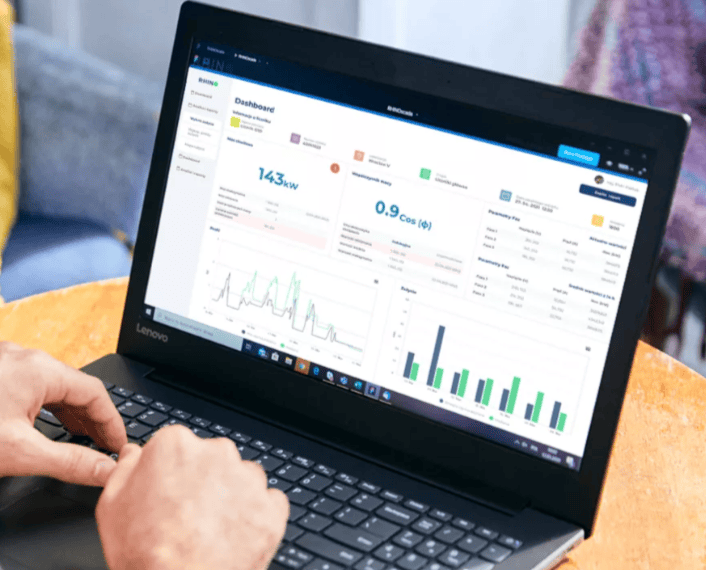

Software to measure and report on building performance

Software tool to analyse building operations

Carbon performance scoring and verification tool for construction