Assessment tool to help landlords design and implement retrofit programmes

Problem Addressed

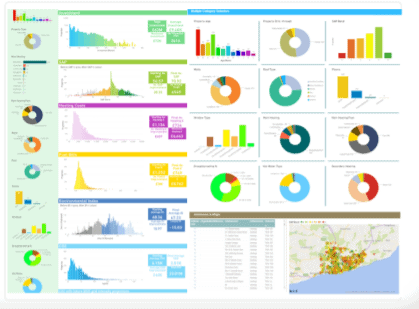

The solution works with local authorities and landlords to develop cost-effective retrofit programmes that meet their cost, comfort and carbon goals. Without having data ready, and the software to model it, local authorities are missing opportunities to bid for funding, to target that funding where it is most needed, and gain efficiencies from layering with other investment.

Case Study

Liz Blackwell, Group Head of Environmental Sustainability, L&Q Group: “The Portfolio tool has played a crucial role in being able to benchmark our housing SAP ratings, track progress and ultimately set meaningful targets. This has made it possible to include SAP targets within our recent sustainability-linked bond £300m bond, focusing on reducing carbon emissions and improving energy efficiency in residential homes, while creating more affordable homes for people at the same time”.

David Smith, Resources Director, Broadacres: “In the Housing Sector the funders are very keen on Associations’/RP plans for reaching SAP C by 2030 and forecasts for Carbon Neutrality in 2050. A lot more of the facilities offered by the Banks and Bonds are linked to achieving ESG targets, now and in the future. They discount the financing for improving SAP ratings in our homes in year, measures to reduce our carbon footprints more generally (for instance replacing fleet with EVs, more landscaping) and improved sustainability in our future development plans. The targets they introduce are being measured annually to ensure continued discount against the loans. Longer term the funders are interested that RPs have a plan in place for both 2030 targets as well as 2050. The Portfolio planning tool has helped Broadacres plan for both of these critical dates, allowing us to incorporate some critical assumptions of our future costs and borrowing needs. The funders are taking these plans; medium and long term very seriously!”

Facts and Figures

This page presents data, evidence, and solutions that are provided by our partners and members and should therefore not be attributed to UKGBC. While we showcase these solutions for inspiration, to build consensus, and create momentum for climate action, UKGBC does not offer commercial endorsement of individual solutions. If you would like to quote something from this page, or more information, please contact our Communications team at media@ukgbc.org.

Related

Assessment service helping local authorities design and implement retrofit programmes

Certifying active travel facilities and services

Climate Risk Data Analytics

Solutions connecting the retrofit value chain