Transforming Real Estate Data into Actionable Sustainability Strategies

Problem Addressed

With the built environment responsible for 25% of the UK’s carbon emissions, the real estate industry carries both an environmental and financial responsibility . Investors and regulators are placing increasing weight on sustainability, making it a decisive factor in asset value, access to capital, and long-term performance. Yet many organisations still struggle to gain a clear picture of how their portfolios are performing which makes it increasingly difficult to develop effective sustainability strategies. Disparate systems, inconsistent reporting, and limited visibility makes it harder to benchmark progress, plan investments, and demonstrate compliance. Without this clarity, owners and managers risk not only falling behind on financial performance and investor expectations but also weakening their competitive position in the market.

Case Study

Deepki partners with Primonial REIM to help them develop a comprehensive sustainability strategy. Primonial REIM has over 1,000 assets throughout Europe and have faced difficulties accessing data from a variety of suppliers and sources, each with different standards. With Deepki, they were able to create a global ESG strategy which they can implement across their international portfolio.

Facts and Figures

This page presents data, evidence, and solutions that are provided by our partners and members and should therefore not be attributed to UKGBC. While we showcase these solutions for inspiration, to build consensus, and create momentum for climate action, UKGBC does not offer commercial endorsement of individual solutions. If you would like to quote something from this page, or more information, please contact our Communications team at media@ukgbc.org.

Related members

Related

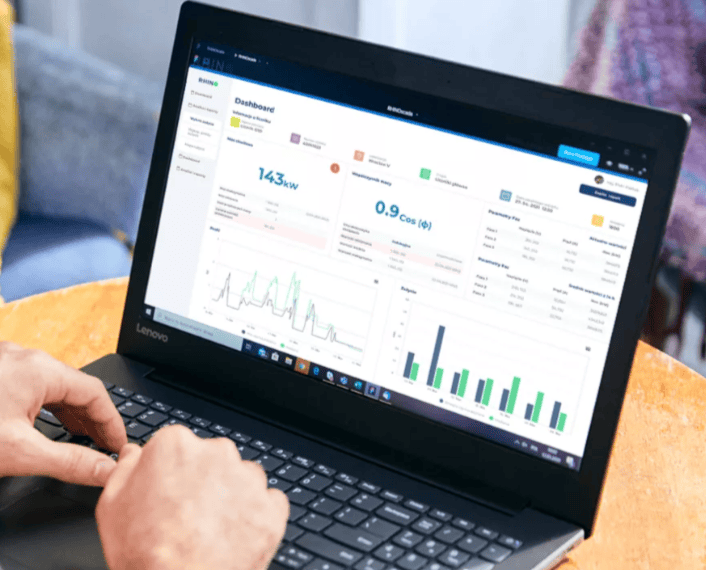

Structured data on building performance

Software to measure and report on building performance

Software tool to analyse building operations

Carbon performance scoring and verification tool for construction