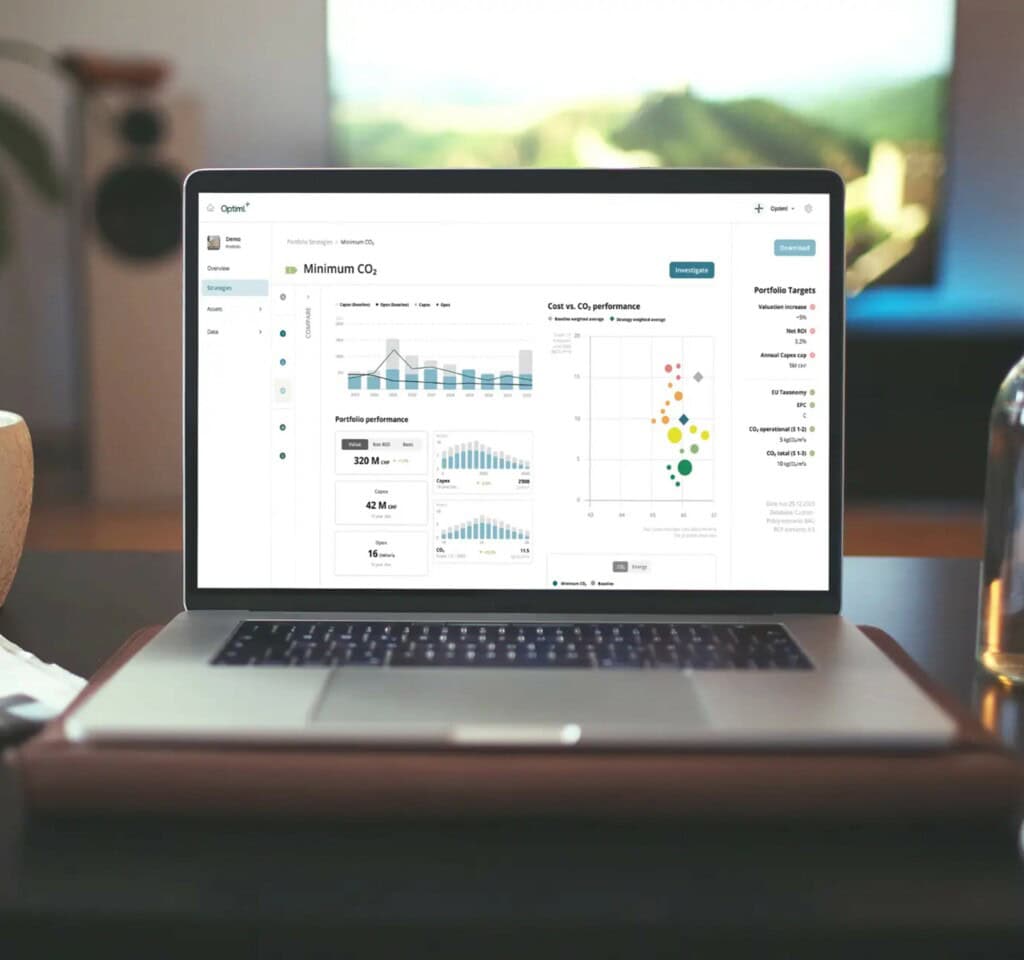

Building and portfolio optimisation SaaS

Problem Addressed

An ever-changing regulatory and market context makes it challenging for Real Estate professionals to develop and adhere to sustainability goals. Without data that is sufficient in scope and quality and with data often scattered across various manual workflows in spreadsheets in different teams, it is difficult to develop the right strategies for investment and renovation decisions that reduce emissions cost-effectively. Now that CO2e is part of the cost function of real estate, asset managers and consultants must find actionable and data-driven strategies to secure profitability.

Case Study

- Background: Consultant developing an office building renovation strategy (constructed 1972), currently EPC F, client wants to re-develop office building for improved rentability and efficiency.

- Building: High glazed area in temperate climate, HVAC systems need urgent replacing, Existing oil heating with heating ceilings, Annual energy data, resorted to Energy simulation with EnergyPlus + SIA norms, District heating available in 2030.

- Results: Optiml “Feasible low CO2” strategy chosen by client, reduces Capex & achieves ROI goal

Oil boiler (107 kW) urgently replaced with temporary Biomass (31 kW) with planned envelope renovation in 2027. District Heating installed in 2040 as main source. - Outcome: Total CO2e (Scope 1-3) saved: 650 tCO2e, Cost of CO2e (Scope 1-3): 545 EUR/tCO2e.

- Impact: Results approved by consultant and moved forward to invesment committee by real estate investor towards tendering. 80% workflow (data and analysis) time reduced with “better” strategies using low-CO2 materials with accurate cost data, adhering to local regulations. Capex reduced by 31% vs. Baseline and 70% operational CO2 savings (Scope 1-2) while achieving 3.75% ROI target.

Facts and Figures

This page presents data, evidence, and solutions that are provided by our partners and members and should therefore not be attributed to UKGBC. While we showcase these solutions for inspiration, to build consensus, and create momentum for climate action, UKGBC does not offer commercial endorsement of individual solutions. If you would like to quote something from this page, or more information, please contact our Communications team at media@ukgbc.org.

Related members

Related

Portfolio level approach to building decarbonisation

Specialist ESG technology platform for multi-tenant real estate

Data collection, insights, reporting and actions for ESG

Platform to help businesses improve energy efficiency.