Responsible offsetting and our pathway to net zero

It’s nearly four years since UKGBC published the Framework Definition for Net Zero Carbon Buildings. The concept has gathered more traction than we could ever have predicted and has been a key influence in the development of the forthcoming UK Net Zero Carbon Buildings Standard. The objective of the Standard is to establish performance targets, which are aligned with science-based trajectories and encourage the built environment sector to play its part in the vital transition to net zero by 2050.

Since the Framework was published, emissions from buildings have been under increased scrutiny. There have been bold efforts to decarbonise the sector in response to this and we must persevere such efforts in order to claim a credible path to net zero. Yet if we follow UKGBC’s trajectory to net zero whole life carbon by 2050, what happens to the remaining residual emissions after embodied and operational emissions have reduced by nearly 90%?

One of the final components of the Framework and indeed the forthcoming Standard is the responsible offsetting of residual emissions. Residual emissions are emissions that cannot be reduced or eliminated through efficiency measures, renewable energy or other low-carbon technologies. These emissions are often unavoidable, and in such cases, responsible offsetting and be an effective way to achieve net zero.

Principles behind carbon credits

Responsible offsetting refers to the practice of compensating for emissions that cannot be reduced or abated through other means – which usually means purchasing verified carbon credits. Credits should meet certain criteria, such as the 10 Core Carbon Principles (CCPs) proposed by the Integrity Council for the Voluntary Carbon Market (ICVCM).

While the CCP’s have only been issued as a draft, ICVCM are developing international principles for high-quality credits that we know should be reflected in UKGBC’s forthcoming guidance on Carbon Offsetting and Pricing.

But given the recent scrutiny in the media about carbon offsets and credits, is there more we can do to define what is “high-quality” or “best-practise”?

Chloe Goulding, Advisor, in our Advancing Net Zero team has been exploring how we can better support the Oxford Offsetting Principles. Issued in 2020, the principles describe the need to shift focus from reducing emissions to removing them from the atmosphere as we approach – and push beyond – net zero emissions. This requires the deployment of technology-based removal technologies, such as carbon capture and storage, and the use of carbon sequestration methods through nature-based solutions.

Technological-based removals are a premium credit that can be purchased on the voluntary carbon market. These are typically based around capturing carbon and storing it in the ground permanently. However, this technology remains expensive and is still in the process of demonstrating its viability on the basis of net carbon impact to the world.

Until there is a viable technological solution at scale, nature-based removals have been an intermediate short-term storage solution to remove greenhouse gasses from the atmosphere. Nature-based removals, such as planting trees, are conceptually easy to understand, cost effective, can promote biodiversity, and improve air quality.

Supporting the transition to removals with a portfolio approach

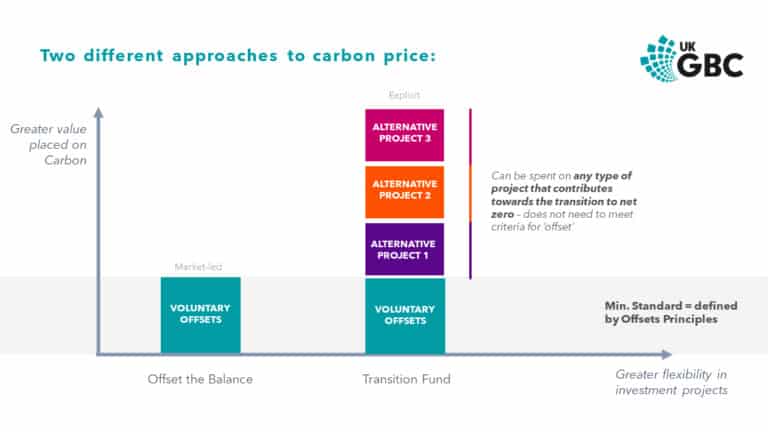

Organisations and consumers seeking to demonstrate leadership can consider taking a Transition Fund approach. By placing a great monetary value on residual carbon emissions, additional projects can be funded, that contribute towards the transition to net zero. Projects may include investing in future removals technologies, which have the ability to store carbon for millennia.

We must also push for greater clarity on co-benefits. The Transition fund approach can support housing or schools retrofit within the local community, and other opportunities to offset at an urban- or UK- scale. It demonstrates a pathway for how responsibly carbon offsets can be used as a force for good in the transition to net zero carbon buildings.

UKGBC’s work on Carbon Offsetting

At UKGBC, we know the market moves fast. That is precisely why we’re updating our 2021 guidance to better equip our members who want to purchase offsets or make investment decisions at building asset or organisational level to do so in a way that aligns with their climate goals and supports the transition to net zero.

For our carbon market to succeed, and for the planet to benefit from the responsible use of carbon offsets, it is vital that industry has access to clear guidance, alongside an effective global governance system.

Related

Net zero carbon buildings: new guidance for renewable energy procurement and carbon offsetting

UKGBC Consults on Renewable Energy Procurement and Carbon Offsetting Guidelines

A journey to carbon neutrality

Net Zero Carbon: Words into Actions