Response to consultation on VAT energy saving materials relief

This HM Treasury call for evidence seeks views on extending VAT tax relief to additional energy saving technologies following an announcement at the Spring Statement 2022 that VAT relief would be expanded providing tax incentives worth approximately £280 million to improve the energy efficiency of homes over the 5 years to 31 March 2027.

We welcome the Government’s commitment to both increase tax incentives by approximately £280 million and to extend the scope of the VAT relief to additional energy saving technologies.

UKGBC is largely technology agnostic, but differential application of VAT relief disadvantages some useful energy saving technologies unhelpfully reducing the options available to home and building owners and reducing the grid balancing potential that these technologies could provide.

You can read the full consultation response here.

Full consultation response

Download the full response

Related

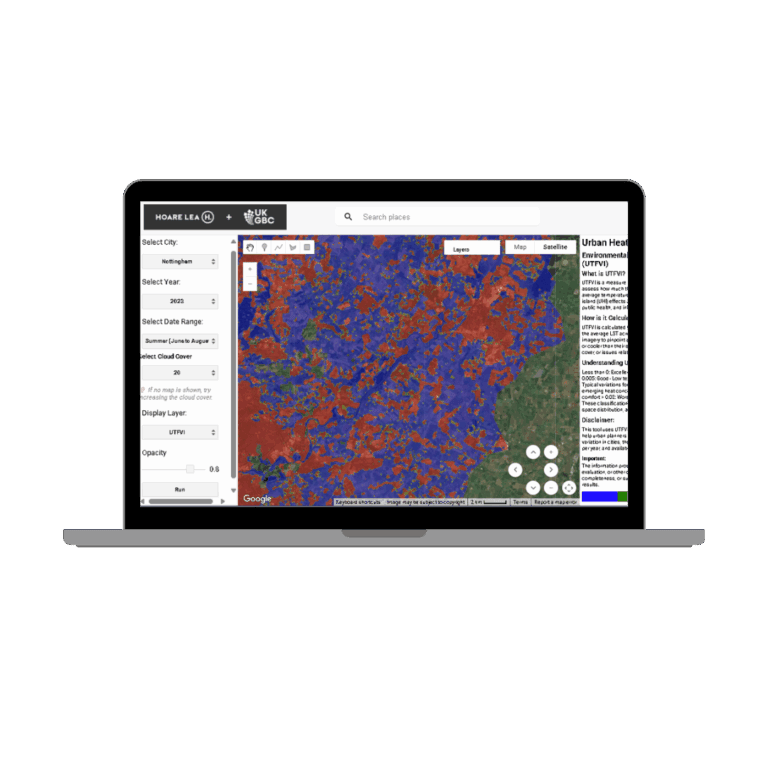

Urban Heat Island Web Map

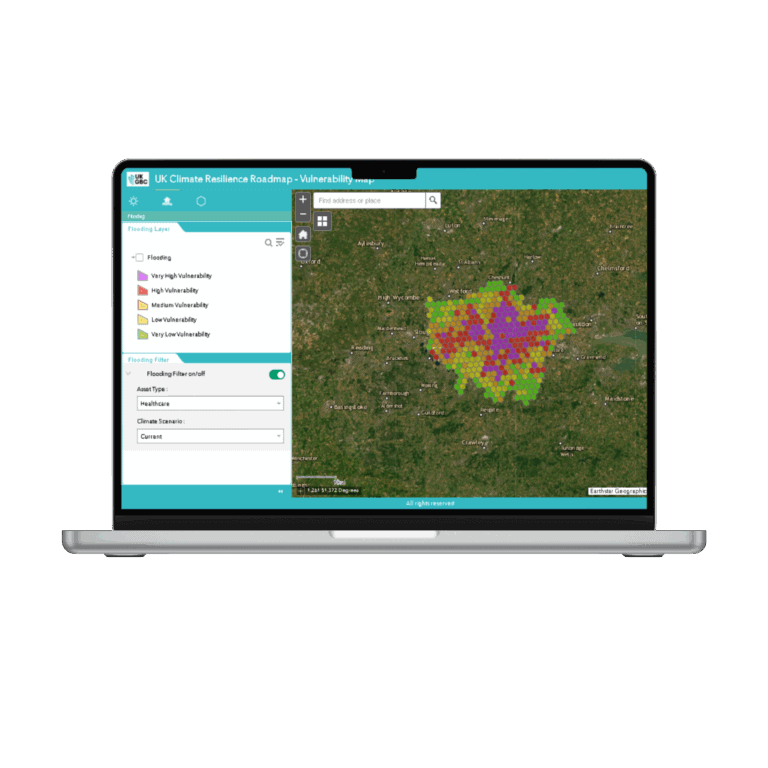

GIS Vulnerability Web Map

UKGBC campaigns to secure Warm Homes Plan funding

Boiler Upgrade Scheme Consultation Response