SaaS climate analytics platform

Problem Addressed

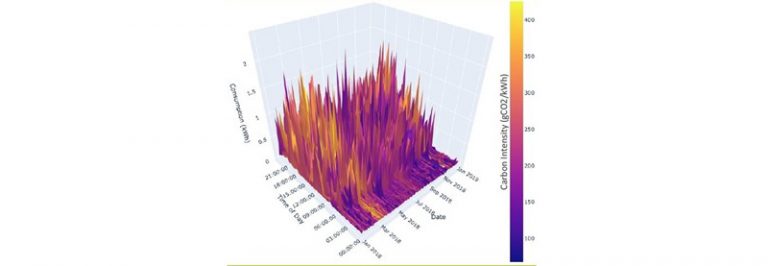

Climate risk is financial risk, and it is accelerating at an alarming rate. It is also a systematic and unpriced risk within our global financial system. Floods, droughts, typhoons, and storm surges result in billions of dollars of losses every year and these losses are set to increase over the next decades. To add to this threat, the climate system is highly interconnected and complex. This makes it challenging to map climate risks to physical assets and critical infrastructure. Effective climate risk mitigation measures are therefore lacking, leaving most assets vulnerable to climate change. Intensel’s mission is to build a more resilient global economy with climate solutions that support real-time, accurate decision-making.

Case Study

Dragon Capital is an investment group focused on Vietnam and other Southeast Asian emerging markets. Dedicated to improving corporate governance, contributing to society, and promoting sustainable development in the countries in which it invests, Dragon Capital (DC) seeks to optimize risk-adjusted performance by integrating ESG factors – including climate change – across its actively managed funds, comprising public equity and bond funds. To this end, in late 2020, Intensel ran its ‘blueswan’ portfolio climate risk assessment on DC’s Veil portfolio of 35 companies and 154 assets in Vietnam.

It is well known that Vietnam has a long coastline, and large deltas housing a rapidly growing urban population. Intensel’s analysis shows that the country faces big challenges in three of the five major physical risk categories: floods, storm surges, and typhoons.

DC and the Intensel team selected those physical assets that, via portfolio weightings and market capitalization, are most significant to the value of the company. It was determined that for Veil the significance is not the current value at risk itself, but rather the likely projected increase in value at risk, until the period 2030-2050, under the given assumptions.

Facts and Figures

This page presents data, evidence, and solutions that are provided by our partners and members and should therefore not be attributed to UKGBC. While we showcase these solutions for inspiration, to build consensus, and create momentum for climate action, UKGBC does not offer commercial endorsement of individual solutions. If you would like to quote something from this page, or more information, please contact our Communications team at media@ukgbc.org.

Related

Climate Risk Data Analytics

Microclimate modelling solution

Solution to provide cheaper finance to build low carbon homes

Results-based climate finance platform