Carbon Offsetting and Pricing Guidance

In March 2021, UKGBC published the Renewable Energy Procurement and Carbon Offsetting Guidance for Net Zero Carbon Buildings. Now two years on, the landscape in which the initial carbon offsetting guidance was published has evolved significantly.

This report aims to provide comprehensive guidance on voluntary carbon offsetting and pricing strategies that are specifically tailored for built assets (both new and existing) and to better equip those who purchase offsets or make investment decisions at building asset or organisational level to align with their climate goals and accelerate the wider transition of net zero.

The report highlights how carbon pricing can be used as a powerful mechanism to accelerate the decarbonisation of built assets and the wider industry. It is also stresses the need for greater ambition when setting an internal carbon price, given the cost of accredited carbon credits on the voluntary market don’t accurately reflect the full societal and economic cost of emitting carbon into the atmosphere.

Key aspects of the guidance include:

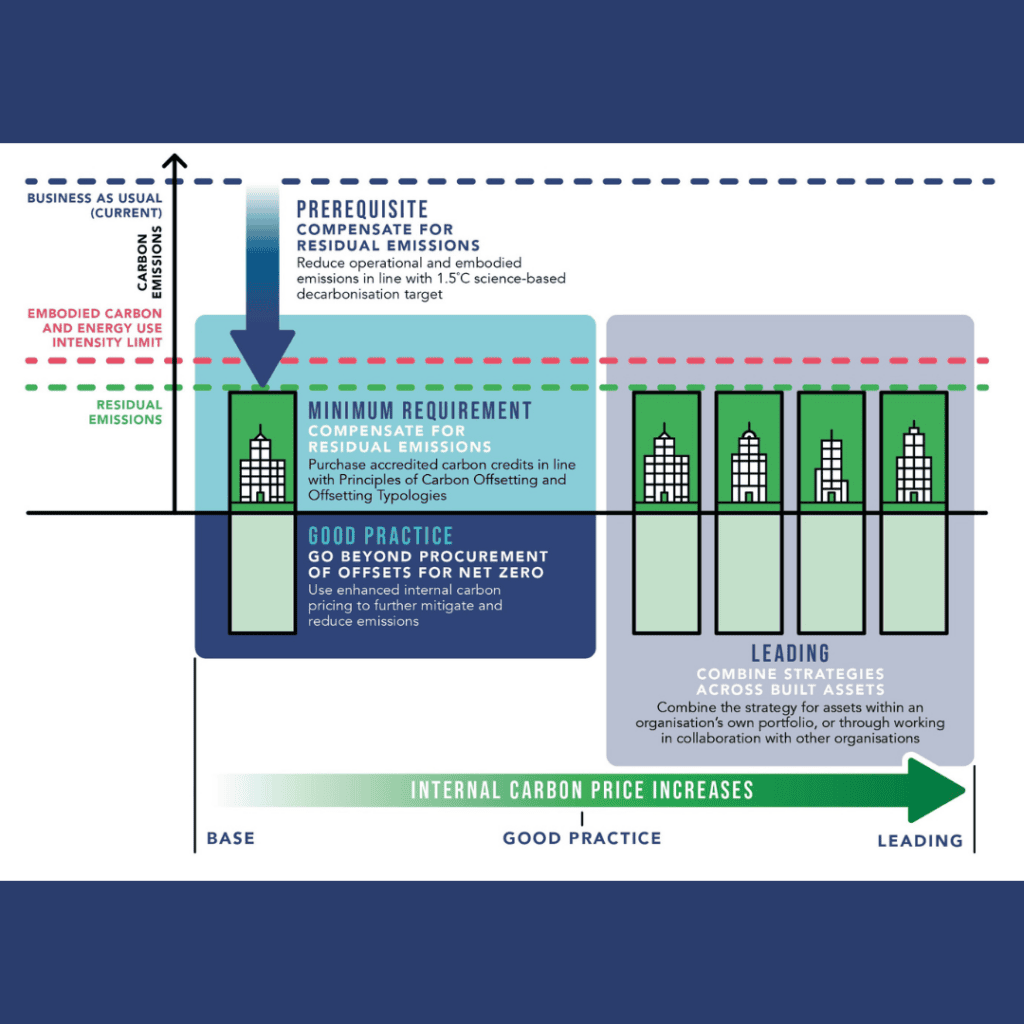

- In recognition of a rapidly changing carbon market, the publication sets out three levels of ambition industry should work towards, with guidance to develop a pathway to adopt a leading approach.

- A step-by-step process to enable real estate developers and investors to take a more holistic approach to ambitious carbon offsetting, which goes beyond basic procurement of voluntary offset credits.

- Provides all practitioners with the vocabulary to describe key offsetting and internal carbon pricing terminology and principles.

Steps for setting an ambitious carbon offsetting plan

Prerequisite

Set Objectives

Set Price

Compensate for Emissions

Review, Purchase and Disclose

June 2024 Update

UKGBC has updated our popular ‘Carbon Offsetting and Pricing Guidance’ in line with new industry frameworks to ensure the integrity and impact of carbon offsetting within the built environment.

- This update reflects recent updates to the University of Oxford’s Revised Oxford principles for net zero aligned carbon offsetting(Oxford Offsetting Principles) and the Integrity Council for the Voluntary Carbon Market’s Core Carbon Principles, Assessment and Assessment Procedure.

- Using the revised Oxford Offsetting Principles, UKGBC’s guidance contains a terminology change away from ‘short-lived storage’ and ‘long-lived storage’ to ‘higher risk of reversal’ or ‘lower durability storage’ and ‘lower risk of reversal’ or ‘higher durability storage’. This recognises that durability and risk of reversal are on a continuum.

- The updated guidance contains updated graphics to reflect terminology changes and new graphics in the Oxford Offsetting Principles.

- Carbon prices have been updated to follow HM Green Treasury book and show a range of prices rather than a single figure.

Related downloads

Carbon Offsetting and Pricing Guidance

Frequently asked questions and answers

“While absolute emission reductions should always be the priority, offsetting is a fundamental part of any net zero transition plan. We’ve seen too many examples of this done badly and UKGBC’s guidance will help companies ensure they’re purchasing high quality offsets that support communities and positive outcomes – a win for the planet and the maturity and credibility of the offset market. We know that companies with science-based decarbonisation pathways that also commit to purchasing carbon offsets reduce emissions faster than those who don’t. We have an opportunity as a sector to take real leadership in this space and offset today what we cannot reduce, so that together we can accelerate the UK’s pathway to net zero.”

Advancing Net Zero Partners

Our Advancing Net Zero work is made possible thanks to our programme partners

Related

Commercial Playbook

Guide to Scope 3 Reporting in Commercial Real Estate

Net Zero Whole Life Carbon Roadmap for the Built Environment

Net zero carbon: energy performance targets for offices